Archive

Embracing Escapism: 70% Plan to Celebrate Halloween This Year

With the U.S. economy on unsteady ground for the past several years, have consumers just given up on a full recovery? We talk about terms like the “new normal” and wonder if the uncertain economy is just now a part of life. But consumers can’t live their lives mired in the doldrums; we seem to be gravitating toward outlets that give us freedom to laugh, enjoy life, and let us forget the everyday “norm.” It’s called escapism. For some, it’s following all things Kardashian, striking up a dialogue on the latest Here Comes Honey Boo Boo exploits, or waiting in line for the new Apple iPhone 5. For many of us – 7 in 10 to be exact – it’ll mean celebrating Halloween this year.

For the past ten years, BIGinsight has been a proud provider of Halloween insights for the National Retail Federation, and this year, we found that 170 million adults will be partaking in the festivities, a new record. Whether it’s attending a party, passing out candy, or even getting Fido in on the act, consumers seem bound and determined to release that pent-up demand for having some fun despite everyday uncertainties. And of the $8 billion dollars consumers are expected to spend on the holiday, nearly $3 billion will be scared up for costumes – and some of this year’s favorites are shown below in the NRF’s Halloween 2012 infographic.

Hot Trends for September: Election, NFL, Fall Fashion

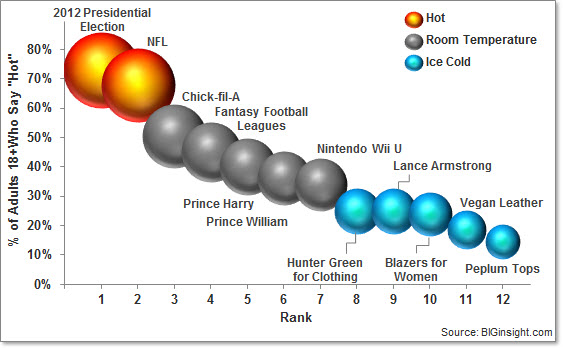

The “Hot or Not?” segment in our September survey was full of current events, personalities, and [my favorite] fall fashion trends. But what trumped the royal family, fantasy football, and peplum tops?

The 2012 Presidential Election.

I guess, though, it would be a little disturbing if the 9,000+ consumers who completed this month’s survey were more excited about the next generation Wii U than the race to the White House. #priorities

Fall’s arrival also has consumers gearing up for the 2012 NFL season as well as fantasy football leagues. And, despite its recent political controversy, Chick-fil-A is still a winner with fast foodies:

In other news, it appears that Prince Harry’s recent antics in Las Vegas only served to endear him further with Americans at large. The royal, now serving in Afghanistan, bested big bro Prince William in our poll this month. Lance Armstrong – with his own “Did he? / Didn’t he?” doping drama – found himself in an unfamiliar position toward the end of the pack this month.

With half the population – i.e. men – finding little to get excited about here, fashion trends typically find themselves in “ice cold” territory. However, it does look like ladies’ best bets for fall are entrenched in the more preppy territory with hunter green and blazers topping vegan leather and peplum tops.

I’m grateful, though, that women under 35 are more psyched about the faux leather movement: while my husband recently gave my leather-like coated denim a big thumbs down [the term “80s groupie” was used], this is a trend I’m planning to stick with…anything to keep you young, right?

For more on what we found “Hot or Not?” for the month of September, plus other consumer highlights, check out this month’s video briefing:

Source: BIGinsight.com

© 2012, Prosper®

BIGinsight™ is a trademark of Prosper Business Development Corp.

The Not-So-Jolly Holiday Outlook for JC Penney Shoppers

2012 hasn’t been kind to JC Penney. And, it doesn’t appear that Q4 will get any better for the department store, which has struggled to shake up its stodgy image this year and in the process has rattled its core customer base. According to the Prosper Spending Index, JC Penney shoppers’ outlook for holiday gift spending falls below that of the general population, with an index of 95.9 (baseline index = 100).* Among JC Penney shoppers with holiday spending plans in mind, two in five (44.2%) plan to spend less on holiday gifts this year than they did for 2011, while fewer than one in ten (7.4%) plan to spend more.

As could be expected, the holiday spending outlook is similar among those shopping Walmart (index = 94.4). Still, a slightly larger proportion of shoppers at the discounter, known to cater to more cash-strapped, lower income households, plans to spend more for the upcoming holiday season (9.5%) compared to JC Penney shoppers (7.4%).

As could be expected, the holiday spending outlook is similar among those shopping Walmart (index = 94.4). Still, a slightly larger proportion of shoppers at the discounter, known to cater to more cash-strapped, lower income households, plans to spend more for the upcoming holiday season (9.5%) compared to JC Penney shoppers (7.4%).

Among the customers analyzed, shoppers at Macy’s, a retailer which has arguably benefited from JC Penney’s EDLP strategy switch-up, maintain the most positive outlook on holiday gift spending, with a Prosper Spending Index of 110.9. TJ Maxx loyalists also hold a brighter-than-average outlook (index = 106.3). Target (102.4) and Kohl’s (101.0) shoppers’ holiday spending plans are in line with the overall average.

So we know JC Penney shoppers will be trying to cut back on their holiday gift spending this year, but just how do they intend to accomplish this?

Memo to Ron Johnson: Your shoppers (or what’s left of them) are still motivated to buy based on sales and coupons.

Among JC Penney customers, nearly half say they are shopping for sales more often (45.4%) and/or are clipping coupons (42.1%) in efforts to help balance their budgets – higher than the overall average. Among the retailers mentioned, Kohl’s shoppers – rabid for that Kohl’s Cash – are the only ones eclipsing both of these figures.

With economic uncertainty pervading consumer mindsets, today’s shoppers – JC Penney’s included – continue to possess an innate need to feel good about spending their hard earned dollars, particularly when it comes to spending on those not-so-essentials like gifts and apparel. And in shoppers’ “feel-good” toolkit are coupons, weekly promos, and special sales. These items are, of course, generally absent from JC Penney’s promotional strategy – setting the department store up for additional customer loss during the critical holiday season.

Think about it like this: getting a $60 sweater on sale for $30 is something to write home tweet about. Simply buying a sweater for the $30 ticket price? It’s a little ho-ho-hum.

* Holiday outlook insights are based on celebrants who have holiday spending plans in mind.

This post originally appeared on Forbes.com as a contribution to the Prosper Now blog.

New September Insights in a Snap!

This month, we’ve introduced the Consumer Snapshot – a concise look at a few trending topics for the month of September, designed to give you a BIG picture view of current consumers.

In this month’s video analysis, we’re examining consumer confidence, practical spending and personal finances, and the pain at the pump. And, we wrap things up with a peek at Holiday 2012 spending plans.

This month’s video is below, but you can also click over to our full version for a short text summary as well as the link to this month’s complimentary PowerPoint analysis.

Interested in becoming a BIG VIP? Please click here to sign up for access to a host of complimentary insights, from our briefings and webinars to press releases and more.

To view the latest BIG Consumer Snapshot in its entirely: September 2012.

Source: BIGinsight.com

© 2012, Prosper®

BIGinsight™ is a trademark of Prosper Business Development Corp

Who wants an iPhone 5?

On the eve of what *may* finally be Apple’s iPhone 5 announcement, we thought we’d check in with our consumers to see how they are handling their possible-new-smartphone-related anxiety.

In our August survey of more than 9,000 consumers, we put the iPhone 5 rumors to the test in our monthly “Hot or Not?” feature. As it turns out, more deemed it “not” (66.1%) than “hot” (33.9%) – placing Apple’s would-be new offering at the low end of our heat spectrum this month, just ahead of current tabloid target Kristen Stewart. [cue Debbie Downer]

Recall the iPhone 5 rumblings a year ago? Consumers were much more likely to hotly anticipate the Apple’s latest iPhone iteration back in August 2011, with the majority (50.7%) feeling the heat – from 2011 to 2012, that’s a 33% drop in hotness! With the iPhone 4S not quite living up to our update expectations last year, it appears that consumers are bracing themselves for a less-than-astounding announcement on September 12. #poorSiri

Recall the iPhone 5 rumblings a year ago? Consumers were much more likely to hotly anticipate the Apple’s latest iPhone iteration back in August 2011, with the majority (50.7%) feeling the heat – from 2011 to 2012, that’s a 33% drop in hotness! With the iPhone 4S not quite living up to our update expectations last year, it appears that consumers are bracing themselves for a less-than-astounding announcement on September 12. #poorSiri

But don’t cry for Apple…it looks like the iPhone 5 [or whatever is soon announced] will have many a shopper clamoring for the new device – particularly among the younger set. Nearly three out of five 18-24 year olds (56.0%) are declaring the 2012 rumors to be “hot,” while those 25-34 index above average as well (45.7%). Expectedly, the temperature on the iPhone 5 buzz gets increasingly chillier as age rises:

With my contract expiring at the end of the year, here’s hoping that Apple’s developed something of grand proportions. You know, it’d be great if Siri could take on my vacuuming. #iwantanappforthat

This post is also trending over on the Prosper Now blog on Forbes.com.

Source: BIGinsight™ Monthly Consumer Survey, AUG-11, AUG-12

© 2012, Prosper®

BIGinsight™ is a trademark of Prosper Business Development Corp.

Amazon #1 In Customer Service, But Will This Lead To Sustainable Loyalty?

- Recently our friends over at the National Retail Federation directed us to Amazon.com, where Founder and CEO Jeff Bezos had once again posted a public letter to customers, this time stating:

I’m happy to report that Amazon has been rated #1 in the National Retail Federation Customers’ Choice Awards…

Why were we excited to see this? BIGinsight compiled the list of Customers’ Choice Award recipients for the NRF Foundation, which was unveiled at their BIG Show earlier this year. These awards recognize the retailers that provide the “best” customer service and were nominated through an unaided, write-in question by (who else?) consumers.

2011 Customers’ Choice Awards: Top Ten (source: NRF Foundation)

- Amazon.com

- L.L. Bean

- Zappos.com

- Overstock.com

- QVC

- Kohl’s

- Lands’ End

- JC Penney

- Newegg.com

- Nordstrom

Customer service in the conventional sense has generally implied face-to-face communication: greeting a customer; providing him/her with product information, demonstrations, additional options, or size assistance; suggesting add-ons or complementary products; and finally, completing the sale. Historically, the best opportunity to cultivate great customer relationships is within an environment where personal interaction between the retailer (i.e. sales associates) and customers is at its peak: a physical store.

So does it surprise you that a traditional brick-and-mortar retailer didn’t top this year’s list? Further, just three of the retailers (Kohl’s, JC Penney, Nordstrom) who graced the top 10 aren’t primarily entrenched in e-commerce, catalog selling, or home shopping.

So how does Amazon rank #1 in customer service?

The digital age has forced the evolution of customer service. In a world where emails and texts have replaced more intimate forms of communication, where shoppers can complete a sale 24/7 via online transactions, and where showrooming is linking the physical shopping experience with the virtual, the modern definition of customer service seems to have downgraded the importance of direct human interaction. And, let’s not forget that customer service in the traditional sense has also been crippled in recent years by an economy fostering a trend toward part-time, minimum wage, less “invested” sales associates.

As the world’s largest online retailer, Amazon has been a driving force behind the e-commerce movement and changing standards for customer service excellence. Some of the words consumers used in their reasons to nominate Amazon for Customers’ Choice included “efficient,” “fast,” “reliable,” “no hassle,” “easy,” and of course, “free shipping.” Note that these terms differ vastly from those who nominated Nordstrom, THE purveyor of traditional customer service: “experience,” “friendly,” “personal,” and “knowledgeable.” [More specific reasons can be found here for each retailer included in the top 10.]

Consider too the e-commerce services that online shoppers (a growing group) value. While the majority indicates that toll free “live” customer service very important or important, this figure has declined nearly 10% from 2007. With customers increasingly gravitating to such services as low prices, free shipping, and easy to use websites over the past few years, it’s obvious that verbal communication isn’t a service prerequisite when it comes to buying online.

But are Amazon’s low prices, free shipping, and efficient turnaround enough to capture sustainable customer loyalty? After all, the troubled economy did create a new consumer – one who shops around, is value-oriented, and may find it increasingly difficult to create ties with one retailer over another.

One of the most fascinating parts of the retail industry is that we are always looking toward for what’s “next” – hot new trends, advancements in technology, gotta-have products, or evolving practices that change the way we do business. Retailers like Best Buy and JC Penney have already announced efforts to ramp up one-on-one interaction to drive customers back to their stores, looking ahead to perhaps a renaissance of traditional customer service.

With its history as a game-changer, though, Amazon just might remain what’s “next” for the foreseeable future.

This post originally appeared on Forbes.com as a contribution to the Prosper Now blog.

Fresh Consumer Insights via Video – August 2012

For those of you who may have missed our latest Executive Briefing, we just wanted to let you know that you still have a chance to get up-to-date on the latest consumer trends via our Video Briefing!

That’s right…in just 5 minutes, we’ll educate you on what you need to know about confidence, consumer spending, unemployment, and retail. Simply click play below to view our latest insights from our Monthly Consumer Survey:

Interested in becoming a BIG VIP? Please click here to sign up for access to a host of complimentary insights, from our briefings and webinars to press releases and more.

For more information on this data, please contact BIGinsight™.

Source: BIGinsight™ Monthly Consumer Survey – AUG-12 (N = 9426, 8/1 – 8/7/12)

© 2012, Prosper®

BIGinsight™ is a trademark of Prosper Business Development Corp.

Consumers: Employment Won’t Improve for Another 2+ Years

While Back-to-School spending buoyed this year and the outlook for Holiday 2012 just *might* be cautiously optimistic, the unemployment rate still seems to be the sticking point between consumers and that “recovery” word.

Those of us “in the know” are aware that the official U.S. unemployment rate remained a discouraging 8.3% for July (not accounting for the underemployed or discouraged workers, of course). What might a spouse, sibling, or parent tell you about the state of the job market though? Your dentist? Your child’s teacher? John [or Jane] Q. Public? If you aren’t tracking this rate on a continuous basis, you would probably be more apt to respond that or the unemployment rate is “high” or the employment situation is “bad.”

In fact, when we asked the more than 3,000 consumers in our latest American Pulse™ survey what they believed to be the current U.S. unemployment rate, respondents’ answers averaged 11.6%. While most consumers (54.4%) felt that the rate was somewhere between 8% and 10%, nearly one out of five (a whopping 18.9%) estimates that the rate is higher than 15%, which is more in line with the Bureau of Statistics’ much less publicized U-6 rate of unemployment.

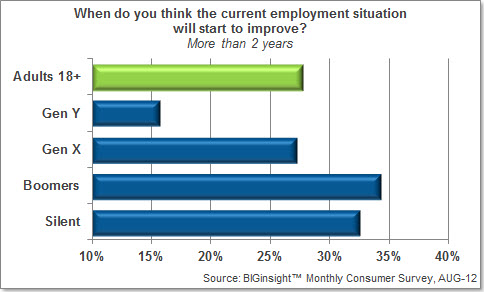

So we’ve established that consumers think the unemployment rate is “high,” but how “bad” do they perceive the employment situation to be? According to our latest insights for August, nearly three out of ten (27.7%) believe it will take more than 2 years for the job market to improve. Fewer place bets on 7-12 months (17.3%), 13-18 months (15.8%), or 19 months to 2 years (16.3%), while just 7.8% optimistically assert that the employment situation has already improved.

So we’ve established that consumers think the unemployment rate is “high,” but how “bad” do they perceive the employment situation to be? According to our latest insights for August, nearly three out of ten (27.7%) believe it will take more than 2 years for the job market to improve. Fewer place bets on 7-12 months (17.3%), 13-18 months (15.8%), or 19 months to 2 years (16.3%), while just 7.8% optimistically assert that the employment situation has already improved.

Among the generations, Gen Y is the group most likely to view the outlook for employment with rose colored glasses; in fact, more than one in ten born between 1983 and 1993 is anticipating improvement in the job market within the next three months. [Holiday hiring season anyone?] The Boomer (born 1946-1964) and Silent (born before 1946) generations maintain a more long-term stance on improving employment, with about a third in each group looking beyond two years from now. Gen X (born 1965 – 1982) is more likely to follow the opinions of the general public.

Now while these insights are interesting, why are they important? Employment remains THE key issue when it comes to discussing the slow growth and recovery of the U.S. economy. Whether on a micro (i.e. personal job security) or macro (i.e. overall economic health) level, doubt in the employment environment breeds uncertain and hesitant spending patterns among consumers. If they fear the pink slips, they’ll snap their wallets shut. If they think they’ll go another year or two or three without a raise or promotion, they’ll think twice about upgrading their homes or cars or about taking a vacation. It’s the retailers, marketers, and advertisers who are attuned to consumers’ concerns that will be better positioned to react and adapt to these realities as the economy sputters toward a long-awaited recovery.

This post originally appeared on Forbes.com as a contribution to the Prosper Now blog.

Does your coffee cup denote how you’ll vote in the Presidential Election?

When you are in need of java fix, are you more likely to head to Starbucks or McDonald’s? Did you ever think that the drive-through you pull up to may indicate which presidential candidate has your vote?

There’s a lot of mud-slinging in the political arena these days—battle lines have been drawn and it seems like every other TV commercial is a negative campaign ad. So we like to lighten the mood here at BIGinsight™ every now and again and look at some unique voter segments to see how they plan to vote in the presidential election. First up were the coffeehouse titans.

I should start by saying that Independent Voters will likely decide the election. The political atmosphere is anything but bi-partisan and Republicans and Democrats appear to be behind their candidate. But Independent Voters who plan to vote in November are split. Our analysis shows that over a quarter of these voters are undecided and therein lies the opportunity for the presidential hopefuls.

So where, oh where (sorry—couldn’t help myself) can these voters be? Our “Coffee Cup Politics” analysis for August takes a look at where they go most often for their coffee and which candidate coffee drinkers from each coffee shop tend to prefer. Check it out…

- Likely Independent Voters who still haven’t made a decision are most likely to head to Starbucks.

- 13.9% saying that’s where they purchase coffee most often.

- McDonald’s comes in at number two among this segment.

- 9.3% go there most for coffee.

- Likely Independent Voters who go to Starbucks most often seem more inclined to cast a ballot for Obama.

- Those who prefer McDonald’s coffee are more likely to vote for Romney.

- It’s interesting to note that over a quarter of each voter group remains on the fence and historically unsure votes tend to end up in the challenger’s tally.

For further insight, take a listen as our Consumer Insights Director, Pam Goodfellow, discusses the analysis on one of our favorite local morning radio programs: http://ow.ly/dbpWf

Source: BIGinsight.com

2012, Prosper®

The Showroom Showdown: Best Buy vs. Amazon

Once upon a time, Best Buy was a magnet for shoppers. We came, we saw, and we unflinchingly bought. Fast forward to 2012, and Best Buy is seemingly no longer a “best bet” among consumers. The big box made news recently, not because of stellar sales performance, but because of its store closings, layoffs, and failure to evolve with changing consumer needs. Best Buy’s growing reputation as Amazon.com’s showroom isn’t doing much to help the matter, either.

For this post, you’ve got ringside seats to the bout pitting the big box veteran against the online “underdog.” We’ll go three rounds with BIG insights to see who might have more long-term stamina.

Round One: Customer Share

It’s interesting to note that – despite its troubles – Best Buy still remains a top-of-mind reference among electronics shoppers. About a third of the 8,000+ consumers we talk to each month indicate they shop most often at Best Buy for electronics (an unaided, write-in response), leading Walmart (with about 20%) as well as Amazon.com (just under 10%). Further, our 10+ years of insights show us that Best Buy’s lead as the store shopped most often hasn’t been challenged – ever.

Amazon didn’t start gaining traction in this category until late 2009 (the same year which marked Circuit City’s demise) and has been steadily been increasing ever since. However, with Best Buy’s current customer share quadruple that of Amazon, the online giant will have to vastly pick up its growth pace to catch up with Best Buy within the foreseeable future.

Winner: Best Buy. There’s still equity in the Best Buy nameplate – and that’s a high percentage of customers who still consider the big box their prime destination for electronics.

Round Two: Cross-Shopping

Let’s discuss the meaning of the “shop most often” phrase we use to gauge customer share; the term “shop” can mean “browse” and/or “buy.” So while it appears that Best Buy may be the store shoppers head to or think of first for electronics, the retailer’s recent performance suggests that it isn’t the only option (i.e. they are, in fact, shopping around). And in the realm of high-dollar electronics, who can blame them in this economy?

We collected some interesting cross-shopping insights in July that highlight Best Buy’s current predicament:

– Among Best Buy’s most loyal electronics shoppers, 51.6% admit to surfing Amazon (for any category) within the past 90 days. Fewer (40.6%) perused the offerings at Best Buy during this same time period. Ouch.

– On the flip side, among Amazon’s most loyal electronics shoppers, a whopping 92.4% had visited the site within the past three months, while just 16.8% had been curious enough to enter a Best Buy. Double ouch.

Best Buy’s electronics shoppers were more prone to visiting Amazon within the past 90 days than the big box itself.

Is there any loyalty towards retailers in an uncertain economy? As evidenced by our cross-shopping data, Best Buy customers were more likely to head to Amazon than they were to the big box itself in the past 90 days. Granted, they could have been surfing Amazon for books, toothbrushes, or even apparel, but how hard would it have been to check out the electronics offerings? Just a few mouse clicks.

Winner: Amazon. While the online retailer’s customer share for electronics is relatively minor, Amazon’s vast product offerings are a major plus with shoppers.

Round Three: Price Comparisons and Showrooming

One of the biggest retail buzzwords today is “showrooming”: the art of demoing merchandise in a physical store and using mobile devices to locate the retailer with the best price. It’s the most modern way to compare prices [for now].

When Best Buy began reporting problems, pundits began pointing the finger at showrooming (and that handy little Price Check by Amazon app). But are Best Buy’s customers guilty of using the big box’s sales floor for this purpose?

Also in July, we found that among Best Buy electronics shoppers carrying mobile devices, 67.1% regularly or occasionally comparison shop via their mobile devices – and about two in five (38.3%) use Amazon’s Price Check app specifically (regularly or occasionally). However, these figures aren’t out of line with what we recorded for Amazon’s mobile-wielding electronics shoppers: 70.4% regularly or occasionally compare prices using their smartphones or tablets and a higher percentage (45.4%) utilize the Price Check app. Further, these percentages are nearly identical to mobile owners in general (67.2% compare prices with their devices; 40.3% report using the Price Check by Amazon app).

While showrooming may be contributing to the big box’s woes, it’s evident that this isn’t a “problem” unique to Best Buy in particular. Showrooming just “is” – it’s another smart shopping strategy being adopted by today’s well-informed consumers and an inevitable trend born from the mobile movement.

Winner: Amazon. The online retail threw a hard punch at more retailers than just Best Buy when it introduced the Price Check app. And the intel it receives from Price Check participants ensures that Amazon’s sticker prices remain low – making non-price competition a “must” for other retailers.

Best Buy seems to be missing the benefit of its so-called showroom status: the retailer has the initial opportunity to make a direct connection with customers and close the sale before shoppers begin scanning SKUs. Instead of placing blame on Amazon and the showrooming trend, perhaps these are the real questions we should be asking: Why has Best Buy failed to capitalize on the customers entering their stores? And, why haven’t shoppers felt compelled to buy from Best Buy once inside the store? Where is Best Buy’s value proposition to its customers?

With pricing transparency between retailers only likely to increase as we become a more technologically-savvy society, Best Buy’s near knockout should serve as a warning. Retailers will have to look to their customers – creating value that will fulfill customers’ needs, fit their budgets, and leave them feeling good about their purchases – and wanting to return for more.

This post originally appeared on Forbes.com as a contribution to the Prosper Now blog.