Generation Gap: Confidence Defined

The components that contribute to confidence can differ from person to person. Is the stability of the national economy most important? Where do personal concerns with employment, finances, and the future come into play? Does the stock market influence anyone’s sentiment regarding the economy?

In this new analysis of the more than 9,000 respondents who completed our March Consumer Survey, we’re taking a look at how consumers define confidence. And, to make it even more interesting, we’re dissecting this data by generation:

Silent (born 1945 or earlier)

Boomers (born 1946 – 1964)

Gen X (born 1965 – 1982)

Gen Y (born 1983 – 1993)

Among adults in general, “Trust in the stability of the national economy” was deemed to have the most influence when determining one’s level of confidence (49.5%). “Trust that your future financial situation will improve” (44.3%), “Trust in employment conditions and your ability to get or keep a job” (42.5%), and “Trust in a positive future for your family” (39.9%) followed.

While stability of the national economy was important across all generations, it is most valued among Silents (60.5%) and Boomers (55.3%) – and was each of these segments’ top confidence influencer. The younger sects, though, were more likely to define confidence from a more personal perspective. Nearly half of Gen Y-ers (46.4%) said that employment conditions/ability to keep a job was most influential; this was also the #1 confidence component for Gen X (45.8%).

Gens X (42.6%) and Y (43.3%) were also more likely to add “Trust in a positive future for your family” to their confidence equation compared to Boomers (38.3%) and particularly Silents (33.3%). “Trust in the future place of employment” was important to nearly a third of each generation, save for the Silent generation (13.4%) – presumably with retirement in sight, or at hand, for these consumers.

Additionally, the older the generation, the more likely that macro-environmental issues play a role in defining confidence. “Trust in government’s international policy,” “Trust in stock market,” “Trust in government’s domestic policy,” and “Trust in regional economy” peaked among Silents and tapered off with declining age.

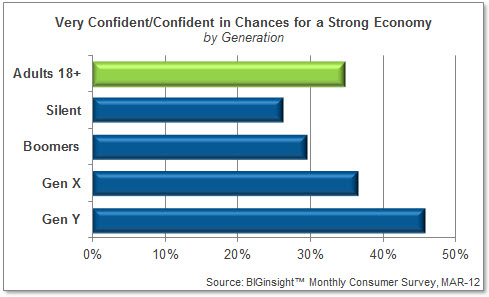

No matter how you define confidence, though, the slow improvement we’re seeing for consumer sentiment (currently at 34.8%) is a step in the right direction for an economy – and a population – that have been struggling for several years. Stay tuned to see if this optimism can be sustained throughout the springtime or if rising gas prices with quash this good feeling.

For more information on this data, please contact BIGinsight™.

Source: BIGinsight™ Monthly Consumer Survey – MAR-12 (N = 9242, 3/6 – 3/13)

© 2012, Prosper®

BIGinsight™ is a trademark of Prosper Business Development Corp.