Consumer Buzz: Women’s Clothing

According to new analysis by BIGinsight, department stores are more buzzed about than discounters when it comes to shopping locales for feminine apparel.* For this special report, we’ve applied the Net Promoter Score** metrics system to our April Consumer Survey data to show how consumers perceive their Women’s Clothing store of choice.

Here, we took the percentage of a destination’s detractors from the number of those who actively promote their Women’s store of choice, which helps us evaluate the strength of a retailer’s image for the Women’s Clothing category. And, among the Top 5 stores for this segment, we found that Kohl’s receives the most net positive buzz (NPS = 36.2%) from its customers, followed by Macy’s and JC Penney (see below). While Target’s NPS was significantly lower than its department store counterparts (at 2.6%), the discounter still garnered an overall positive rating. That other big discounter – Walmart – was the only retailer in the Top 5 to calculate a negative NPS (-10.3%)…ouch.

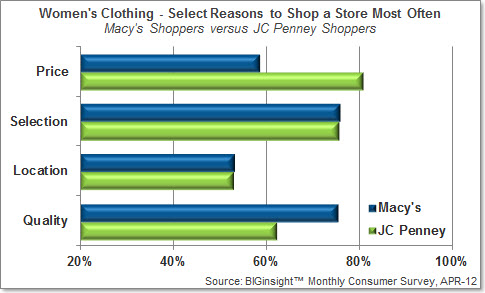

It’s interesting to note that while the most buzzed about retailers are department stores by definition, each courts customers based on varying motivations. For the Kohl’s and JC Penney shoppers, price and selection are the key reasons to peruse their racks; for Macy’s, it’s quality and selection. At Walmart, customers shop based on price and location, while Target woos shoppers with a mix of price, selection, and location (shoppers seem divided between the latter two).

What analysts are buzzing about, though, is consumers’ reaction to JC Penney’s new “Fair & Square” pricing strategy. As it turns out, JC Penney’s customers just aren’t as likely to be lured by coupons and special deals when it comes to shopping the Women’s section. While Walmart and Target are the least likely to be motivated by this sales simulant, over at Kohl’s, we might see shopper anarchy if this department store darling adopts a similar strategy #kohlscashforever

*April 2012’s Top 5 Retailers for Women’s Clothing (Kohl’s, Walmart, Macy’s, JC Penney, Target) were analyzed for this blog.

**Net Promoter, NPS and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, and Fred Reichheld

The NPS which takes a simple question–Would you recommend us to a friend?–has helped countless organizations better understand “promoters” and “detractors” and paint a clear picture of their company’s performance through the eyes of their customers. By applying the Net Promoter Score*, executives can identify their customer base and move beyond “sufficient” to brand loyalty and growth.

For more information on this data, please contact BIGinsight™.

Source: BIGinsight™ Monthly Consumer Survey – APR-12 (N = 8724, 4/3 – 4/10/12)

© 2012, Prosper®

BIGinsight™ is a trademark of Prosper Business Development Corp.

Pam, this seems like nothing more than data that supports their Brand positioning. There’s a reason for the results: That’s how the retailers position themselves.

Also, is it really valid to say that JCP customers aren’t attracted to sales and coupons now, after they’ve just completed a 3-month blitz saying they were getting rid of those tactics? And consumers aren’t attracted to Walmart and Target for their coupons and deals on women’s clothing because they don’t use those marketing strategies; while conversely, Kohl’s does it continually.

I guess I’m missing the “BIG Insight” here.

Thank you for your comments, Sandy.

The centerpiece of this blog is the data presented via the Net Promoter Score analysis. Department stores tend to be more likely than their discount competition to gather “promoter” buzz.

As far as the supporting data on motivations for Women’s Clothing store shoppers…yes, it’s a common fact that a successful retailer will attract customers based on their positioning strategies. You wouldn’t expect a shopper to head to Saks for an incredible price point just as you wouldn’t anticipate that the average Walmart shopper demands one-on-one, attentive customer service.

But why isn’t it really “valid” to say that JCP customers aren’t as attracted to sales and coupons? It’s not an inference; it’s a a statement of fact – straight from our respondents. According to this month’s survey of nearly 9,000 consumers (MOE +/- 1%), Women’s Clothing shoppers from JCP were less likely to be motivated by coupons and special sales than their Kohl’s shopping counterparts. Perhaps this is where consumer data holds the “insight” – one might assume that JCP shoppers are as rabidly motivated by coupons and special sales as Kohl’s because the two are such close competitors.

And is this really just a result of JCP’s recent “Fair and Square” blitz?

One year ago, 32.2% of JCP’s customers indicated coupons and special sales motivated them to shop this store for Women’s Clothing, which was nearly 30% lower than the response we received from those shopping Kohl’s (44.5%) at the time. So it appears that “Fair and Square” might be the result of JCP listening to what their core customers really want. Whether or not “Fair and Square” will aid JC Penney in gaining and retaining new shoppers remains to be seen, of course, but BIGinsight will be monitoring the action on a month-to-month basis.

Thank you again for your interest in the BIG Consumer Blog.